tax credit community meaning

Abode has been variously defined as ones home habitation residence domicile or. The Child Tax Credit CTC for 2021 is fully refundable if you or your spouse if filing a joint return have a principal place of abode in the United States for more than half of 2021.

LIHTC properties may contain market rate units that are not financially assisted in addition to reduced rent LIHTC.

. It does not offer tax credits to the tenant renting the unit. A 9 credit or a 4 credit Tax credits can be claimed by the investors for 10 years. If you qualify for HCTC its claimed on Form 8885.

Legal Definition of tax credit. A tax credit property is an apartment complex or housing project owned by a developer or landlord who participates in the federal low-income housing tax credit LIHTC program. LIHTC properties may contain market rate units that are not financially assisted in addition to reduced rent LIHTC.

Did you receive a letter from the IRS about the EITC. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property owners.

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe. An amount of money that. 106-554 to provide an incentive to stimulate investment in low-income communities LICs.

The Health Coverage Tax Credit HCTC is a refundable tax credit that pays 725 of qualified health insurance premiums for eligible individuals and their families. The NMTC program was created by the Community Renewal Tax Relief Act of 2000 PL. The more tax credits that apply to you the more you can reduce your income tax.

Projects can qualify for two types of credits. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. It does not offer tax credits to the tenant renting the unit.

20 The original allocation authority eligible for the NMTC program was 15 billion from 2001 to 2007. The TDHCA Housing Tax Credit HTC Program is one of the primary means of directing private capital toward the development and preservation of affordable rental housing for low-income households. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL.

For the advance child tax credit if you received your first payment in July that. A tax credit is a dollar-for-dollar reduction of the income tax you owe. Until a few years ago the promotion of community economic development in low-income areas had to be financed largely by.

Since the mid-1990s the LIHTC program has supported the construction or rehabilitation of about. The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. The LIHTC was enacted as part of the 1986 Tax Reform Act and has been modified numerous times.

Tax credits work well in todays community development environment. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit exceeds your entire tax bill. A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly.

Individual tax credit buildings maintain waiting lists and wait times vary. The federal provincial and territorial governments each provide tax credits which you can use to lower your taxes. 21 Congress subsequently increased the total allocation authority to 61 billion and.

A tax credit differs from deductions and exemptions. An amount that may be subtracted from the sum of tax otherwise due and that is distinguished from a deduction applied to gross income in the calculation of taxable income compare exemption. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property owners.

Find out what to. 2 Waiting List and Application Process. A direct dollar-for-dollar reduction of ones tax liabilityThat is if a taxpayer otherwise owes 2000 to the government in income tax but has 1000 in tax credits then the taxpayer only owes 1000Tax credits may be either refundable or non-refundableA refundable tax credit means that if ones tax liability goes below zero the government owes the taxpayer the remainder of the.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The Low Income Housing Tax Credit LIHTC program provides housing for low- to moderate-income renters in exchange for tax credits for the developersThe LIHTC program is overseen by the Washington State Housing Finance Commission. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero.

An amount of money that is taken off the amount of tax you must pay 2. NMTC investors provide capital to community development entities CDEs and in exchange are awarded credits against their federal tax obligations. Investors can claim their allotted tax credits in as little as seven years5 percent of the investment for each of the first three years and 6 percent of the project for the remaining four years.

To qualify for this credit one of the following must be true. For example based on an investor willing to pay 75tax credit dollar a project eligible for 500000 in annual credits would receive 3750000 500000 in credit x 10 years x 75 in equity. The Low-Income Housing Tax Credit LIHTC program is the most important resource for creating affordable housing in the United States today.

Tax credits are amounts that reduce the tax you pay on your taxable income. Created by the Tax Reform Act of 1986 the LIHTC program gives State and local LIHTC-allocating agencies the equivalent of approximately 8 billion in annual budget authority to issue tax credits for the acquisition rehabilitation or new. Tax credits are awarded to eligible participants to offset a portion of their federal tax liability in exchange for the production or preservation of affordable rental housing.

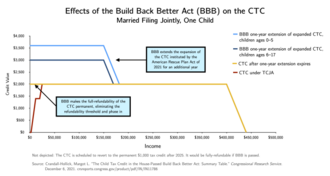

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to 17 years of age. The WOTC is available for wages paid to certain individuals who begin work on or before December 31 2025.

Child Tax Credit United States Wikipedia

The 2021 Child Tax Credit Implications For Health Health Affairs

Child Tax Credit United States Wikipedia

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675293/AP21172645952240.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

R D Tax Credit How Your Work Qualifies Alliantgroup

Child Tax Credit United States Wikipedia

Child Tax Credit United States Wikipedia

Tax Season What You Need To Know To Claim The Child Tax Credit

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit United States Wikipedia

What Are Tax Credits Turbotax Tax Tips Videos

How To Structure A Permanent Child Tax Credit Expansion

What Is The Earned Income Tax Credit

Child Tax Credit United States Wikipedia

Child Tax Credit United States Wikipedia

Tax Season What You Need To Know To Claim The Child Tax Credit

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675308/GettyImages_1233580576.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

/TaxCredit-cd8d4101b88f4d94afcf390b63f1738b.jpg)